E-commerce startup Zilingo raises $226M to digitize Asia’s fashion supply chain

If you’re looking for the next unicorn in Southeast Asia, Zilingo might just be it. The 3.5 -year-old e-commerce company announced its decision has raised a Series D round worth $226 million to go after the opportunity to digitize Asia’s fashion supply chain.

This new round makes Zilingo to $ 308 million from investors since its 2015 opening. The Series D was guaranteed by existing investors Sequoia India, Singapore sovereign fund Temasek, Germany’s Burda and Sofina, a European ally of Flipkart-owned manner site Myntra. Joining the party for the first time is new investor EDBI, the corporate financing appendage of Singapore’s Economic Development Board.

Zilingo isn’t commenting on a valuation for the round, but information sources with knowledge of the batch told TechCrunch that it is’ a rounding wrongdoing’ away from$ 1 billion. We had discovered in recent months that the startup was getting close to unicorn status, so that is likely to come sooner or later — particularly given that Zilingo has established it to Series D so rapidly.

Raising more than $300 million prepares Zilingo one of Southeast Asia’s highest-capitalized startups, but its meteoric growth in the last year has come from expansion from shopper e-commerce into business-to-business services.

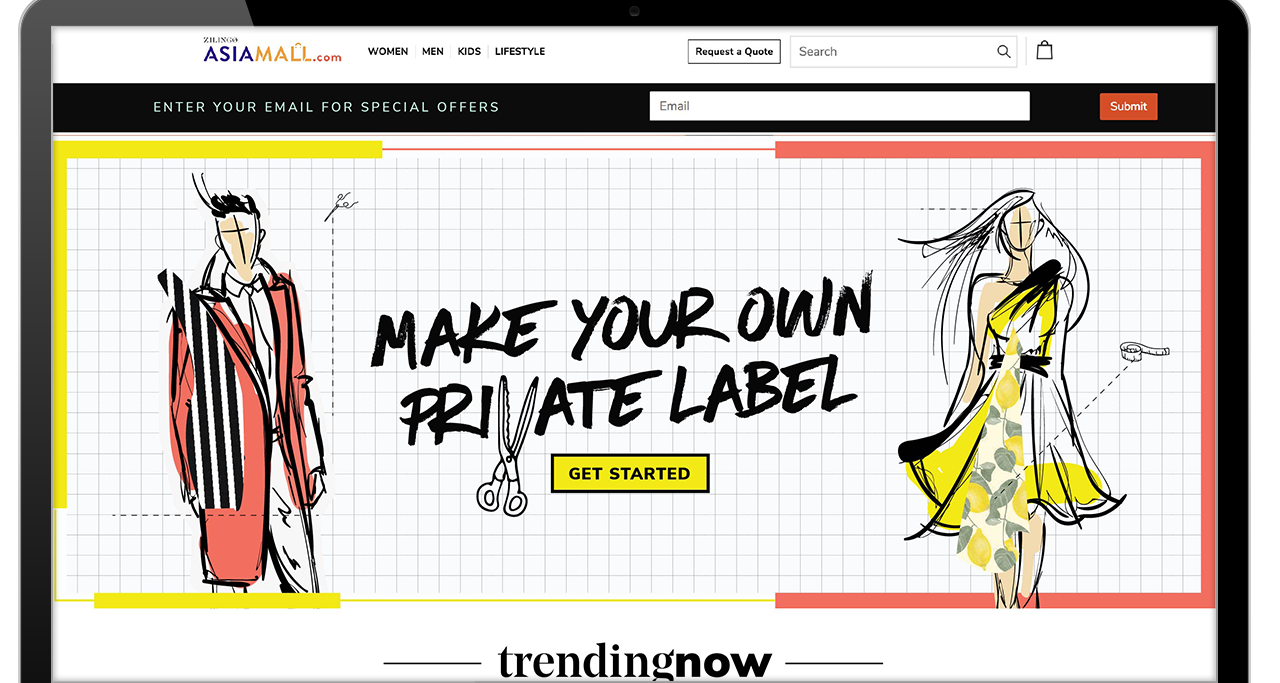

CEO Ankiti Bose — formerly with Sequoia India and McKinsey — and CTO Dhruv Kapoor firstly improved a service that capitalise on Southeast Asia’s growing internet connectivity to draw small-scale fashion vendors from the street markets of cities like Bangkok and Jakarta into the e-commerce fold. Zilingo still operates its consumer-facing online retail store, but its key move has been to go after b2b opportunities in the render chain by digitizing its network to give retailers and symbols gain access.

Revenue grew by 4X over the past year, with b2b responsible for 75 percent of that total, Bose told TechCrunch. She declined to provide raw chassis but did say net income is in “the hundreds of millions” of U.S dollar. The corporation — which has over 400 staff — isn’t productive more, but CEO Bose said the b2b segment leaves it” a clearly defined pathway” to break-even by curing offset expensive e-commerce battles.

Ankiti Bose and Dhruv Kapoor founded Zilingo in 2015.

The furnish chain’s’ outdated tech’

Moving into the afford bond after building dispensation offsets impression, but Zilingo has long had its look on services.

That business-focused approach began with a suite of basic commodities to facilitate Zilingo marketers cope their e-commerce business. Those initially included inventory management and sales moving, but they have since graduated to deeper services like financing, sourcing and procurement, and a’ style hunter’ for identifying upcoming way tendencies. Zilingo likewise increased its target from the long posterior of small-scale merchants operating in Southeast Asia, to big sellers and symbols and even to the fashion industry in Europe, The americas and beyond that tries access to Asia’s farmers, who are estimated to account for $1.4 trillion of the$ 3 billion global pattern inventing market.

Zilingo’s goal today is to provide any vendor with the features, revelation and structure that brands such as Zara have built for themselves through years of work.

In Southeast Asia, that implies curing small-minded merchants, SMEs and larger retailers to beginning entries for sale online through the Zilingo store. But in Europe and the U.S, where it doesn’t operate an shop, Zilingo get directly to the marketers themselves. That could mean retailers striving wholesale possibilities from Asia or online influencers, such as Instagram temperaments, lament to use their existence for e-commerce. Beyond really picking out items to sell, Zilingo wants to help them build their own private names expending its furnish bond network.

That rest of the world scheme has been on the cards since last year when Zilingo shut a $54 million Series C, but now the next stage of the wander is deeper integrated in factories.

” If you think about these plants that do the products, the process isn’t optimized over there ,” Bose said in an interview.” The chap or daughter extending factory likely has no further engineering, they don’t even use Excel. So we’re going to small and medium plants, increasing faculty utilization, helping to manage payroll, get lends and other fintech works .”

Kapoor, her co-founder, adds that the pattern give chain is” is impaired by outdated tech .”

” It’s obligation for us to build products that pioneer machine learning and data discipline effectively to SMEs while also being easy to use, get adopted and scale swiftly. We’re re-wiring the entire render chain with that lens so that we can add most value ,” he lent in a statement.

Zilingo spurs retailers and firebrands to develop their own private names by tapping into the equip chain network it has built

AWS for the fashion give order

Bose said Zilingo’s early exertions have boosted plant efficiency by some 60 percent and saw it is feasible to develop linked to retailers while also permitting mills to develop their own private description colletions, rather than simply churning out unbranded or non-descript products.

A large-scale part of that work with factories is consultancy-based, and Zilingo has hired supply series experts to help provide quality guidance and position alongside the software tools it offers, Bose said.

She likens it, in many ways, to how Amazon conceived AWS. After it built tech to correct its own difficulties internally, it commercialized the services for third party. So Zilingo started out offering a consumer-facing e-commerce pulpit but it is meeting its sourcing systems is accessible to anyone at an estimated cost — almost like equip chain on an API.

That dedicates its business a two, if not three, surfaced focus which encompasses exchanging to purchasers in Southeast Asia through Zilingo.com — which is present in Thailand, Singapore, Malaysia and Indonesia with the Philippines and Australia coming soon — contacting overseas retailers through Zilingo Asia Mall, and developing the b2b play.

In Southeast Asia, its residence grocery, Zilingo doesn’t stress its sellers to sell on its platform exclusively –” we don’t mind if they go to Instagram, Lazada, Tokopedia and Shopee ,” Bose said — but in the U.S. it doesn’t have a go-to customer shop. It’s possible that might change with the company considering possible partnerships, although it seems unlikely it will launch its own customer play.

Zilingo was once destined to compete with the big-hearted actors like Lazada, which is owned by Alibaba, Shopee, which is operated by NYSE-listed Sea, and Tokopedia, the$ 7 billion fellowship that’s part of SoftBank’s Vision Fund, but its supplying order focus has altered its position to that of enabler.

That’s facilitated it eschew complicated durations for professional e-commerce services, which debate tough rivalry, pricing campaigns and challenging dynamics, and instead become one of Southeast Asia’s highest-capitalized startups. The company’s U.S. mean is ambitious, and it is taking longer than expected to get off the ground, but that meets it a startup that is worth hindering an look on in 2019. It’s also an example that the startup expedition is not characterized since, in a number of cases, the biggest opportunities aren’t presented immediately.

Read more: feedproxy.google.com