Security tokens will be coming soon to an exchange near you

Sunny Dhillon

Contributor

Sunny Dhillon is a partner at Signia Venture Partners.

More berths by this sponsor

Amazon’s next conquest will be apparel

The rise of experiential industry

While cryptocurrencies have generated the lion’s share of investment and attention to date, I’m more excited about the potential for another blockchain-based digital resource: security tokens.

Security signs are defined as “any blockchain-based representation of value that is subject to regulation under insurance laws.” In other words, this constitutes possession in a real-world asset, whether the hell is equity, debt or even real estate.( They likewise include certain pre-launch utility signs .)

With $ 256 trillion of real-world assets in the world, the chances of crypto-securities is truly massive, especially with regards to asset categorizes like real estate and fine art that had traditionally suffered from limited exchange and liquidity. As I’ve written previously, guess if real estate was tokenized into protection tokens that it is able to transactions as safely and easily as you do stocks. That’s where we’re headed.

There’s a lot of forward force around tokenized certificates, so much so that on the basis of their current path, I repute insurance tokens are going to become a common part of Wall Street parlance in the near future. Investors won’t just be able to buy and sell tokens on mainstream exchanges, however; “crypto-native” firms are also hurling their hats into this ring.

The starter pistol has been fired

The race is on to bring insurance clues to the masses

Because Bitcoin and other cryptocurrencies are not classified as protections, it’s been much easier to facilitate trading on a large scale. Security tokens are more complex, involving not just abilities around trading, but also issuance and, critically, conformity.( Receive more of my designs on compliance here .) It’s a major enterprise, which is why we haven’t construed the Coinbase or Circle of security token trading emerge hitherto( or assured these companies expand their programmes to address this–more on that last-minute ).

Meanwhile, regular exchanges are flaming the trail and moving into providing tokens trading. The founder and chairman of the company that owns the NYSE announced a brand-new undertaking, Bakkt, that would offer an on-ramp for institutional investors interested in buying cryptocurrencies. Last month, the SIX Swiss Exchange–Switzerland’s principal capital trading exchange–announced plans to build a settled exchange for tokenized certificates. The trading and problem programme, SIX Digital Exchange, will adhere to the same regulatory criteria as the non-digital exchanges and be overseen by Swiss monetary regulators.

This announcement supports a few things 😛 TAGEND

Most resources( capitals, alliances, real estate, etc) will be tokenized and supported on regulated trading platforms.

Incumbents like SIX have a head start due to their size, regulatory licensing and built-in user base. They are likely to use this advantage to defend their position of power.

Most investors will never know they are using distributed record engineering, let alone trading tokenized resources. They will simply buy and sell resources as they ever have.

I expect other large financial exchanges to follow SIX’s lead and onboard crypto trading before long. I can imagine them salivating over the trading fees now, Homer Simpson style.

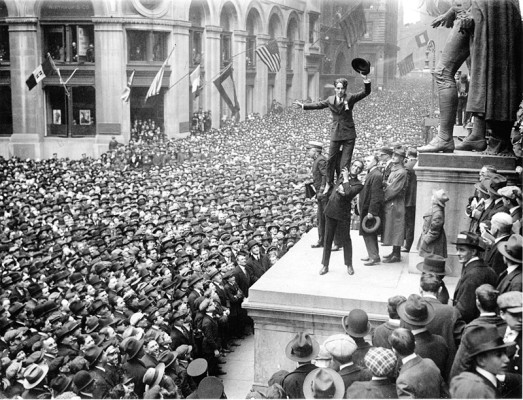

Live shot of financial exchanges drooling over crypto trading fees

Crypto companionships are revving their machines

The big crypto fellowships are preparing to enter security rights token arena

Stock exchanges won’t have the cavity to themselves, however. Crypto business like Polymath and tZERO had previously been debuted dedicated pulpits for security tokens, and all mansions indicate notices from Circle and Coinbase launching their own tokenized resource exchanges are not far behind.

Coinbase is much closer to offering protection clue concoctions after acquiring a FINR-Aregistered broker-dealer in June, effectively backward-somersaulting its lane into a district of regulatory compliance. President and COO Asiff Hirji all but substantiated crypto-securities are in the company’s roadmap, saying that Coinbase “can envision a world where we may even work with regulators to tokenize dwelling different kinds of securities.”

Circle is also laser-focused on insurance clues. Circle CEO and co-founder Jeremy Allaire interpreted the company’s possession of crypto exchange Poloniex and propel of app Circle Invest in terms of the “tokenization of everything.” In add-on, “its by” pursuing registration as a broker-dealer with the SEC to facilitate token trading–it could also “ve been trying to” make the same backdoor possession approach as Coinbase.

If there’s a intellect Circle and Coinbase haven’t moved into security token works even more rapidly, it’s that are still simply aren’t that many security clues yet. Much of this is due to the lack of compliance and issuance programmes, restraining high-quality securities on bequest methods issuers feel more comfortable with. As jobs like Harbor ramp up more, this comfort gap will grow smaller and smaller, driving the big crypto players deeper into security token services.

The old guard vs. the new wave

Expect a battle between traditional and crypto exchanges.

This showdown between traditional busines incumbents and crypto whales will be worth watching. One is incentivized to perpetuate the status quo, while the other is looking to create a brand-new, more world financial system.

The Swiss SIX Exchanges of the world enjoy some definite advantages over the likes of Coinbase — they have decades of traditional fiscal operating event, penetrating affairs throughout the industry and a head start on regulatory compliance. Those advantages possibly mean that such incumbents will probably be the first to form infrastructural and logistical improves to their arrangements consuming insurance tokens. The first time you interact with a protection sign, it is likely to be through the Nasdaq.

Having was of the view that, incumbents’ greatest disadvantage is likely to be moving an old-finance-world mentality to these inventions. Coinbase, Circle, Polymath, Robinhood and other newer participates are better suited to reining the stepchange elements of security signs — particularly asset interoperability and imaginative defence design.

University of Oregon Professor Stephen McKeon, an official on security clues, “ve told me” that” the potential for programmable defences to permit the saying of new speculation categories is the most exciting piece .” Harbor CEO Josh Stein explained why private securities in particular will be converted: “by automating compliance, issuers can allow their investors to sell to the limit of their liquidity across various exchanges. Now reckon a world-wide where buyers and sellers around the world can transactions 24/7/ 365 with near instantaneous colonization and no counterparty jeopardy- that is something only possible through blockchain.”

Those hypergrowth startups are going to experiment with these new paradigms in ways that older conglomerates won’t must be considered. You can see evidence of this forward considering in Circle’s efforts to build a payment network that allows Venmo users to transport price to Alipay users — accurately adopting interoperability, if not in an resource sense.

The race is on

As Polymath’s Trevor Koverko and Anthony “Pomp” Pompliano have been saying for the past year, the financial services world-wide is moving towards insurance tokens. As the crypto economy matures, we’re inching closer to a brand-new age of real-world resources being securitized on the blockchain in a regulatory compliant manner.

The challenge for both traditional and crypto exchanges will be to educate investors about this new highway to buy and sell assets while powering these securities events via a smooth, seamless knowledge. Ultimately, security signs lay the groundwork for conceding investors their biggest please — the ability to trade equity, indebtednes, real estate and digital resources all on the same platform.

Read more: feedproxy.google.com