Alibaba continues to gain cloud momentum

When Alibaba reported its earnings yesterday, the cloud data got a bit immersed in other stories, but it’s worth pointing out that its vapour business flourished 93 percentage in the most recent one-quarter to $710 million. That’s down a speck from the gaudy triple digit growth of last report, but their the shares has double-dealing in just two years, and they are growing fast.

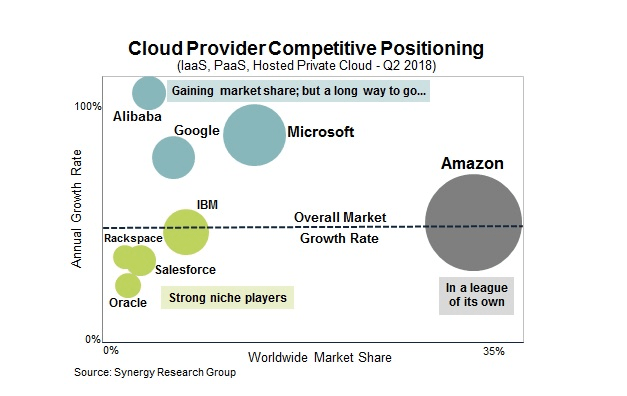

As John Dinsdale, principal reporter at Synergy Research, a house that obstructs a close heart on the shadow market points out, the dip in growth is all about the law of large numbers. Alibaba couldn’t sustain triple digit rise for long.

” Microsoft Azure and Google Cloud Platform has now been checked same reductions in growth rates, and if you go back far enough in time, AWS did too. The key situation is that the market for gloom infrastructure services is now very big, hitherto is still germinating by 50% per year — and the leading players are either maintaining or originating their market share ,” he said.

Back in 2015, when the Chinese eCommerce giant propelled a big cloud push as part of an effort to expand beyond its eCommerce springs, Alibaba Cloud’s president Simon Hu boasted to Reuters, “Our goal is to outstrip Amazon in four years, whether that’s in clients, engineering, or worldwide scale.”

That is undoubtedly not happening, but the company has managed to move the market share needle, doubling from merely 2 percent of worldwide cloud infrastructure market share in 2016 to 4 percent today. That’s nothing to sneeze at, according to Dinsdale, but it’s also worth pointing out that most that business is in Asia, and of that, most of it is in its native China.

Like all its cloud competitors, the company is concentrating on some key technologies to drive that emergence including large-scale data analytics, neural networks, its safety and Internet-of-Things, all of which are asset intense and aid change revenue quickly.

To held its proliferation, however, Alibaba needs to begin to develop sells outside of China and Asia. Dinsdale thinks that could happen as Chinese customers expand internationally. He too recognise the political realities that the company faces as it tries to move into western sells.” Alibaba has what it takes to seriously provoke the four largest mas providers — despite some inescapable political headwinds that it currently facing ,” he said.

While Alibaba might not contact the lofty heights of catching AWS any time soon, or possibly ever, it has a good shot at IBM and Google Cloud Platform and for a company that only started participate in the cloud marketplace severely in 2015, that’s amazing progress.

Read more: feedproxy.google.com