Supergiant VC rounds aren’t just raised in China

Jason Rowley

Contributor

Jason Rowley is a venture capital and technological sciences reporter for Crunchbase News.

More uprights by this contributor

July establishes a record for number of $100 M+ risk capital rounds

WeWork is just one facet of SoftBank’s bet on real estate

In the venture capital marketplace, big is in. Houses are invoking significant sums to commerce a growing number of big startup fund rounds.

In July, there used 55 venture rounds, worldwide, which exceeded out at $100 million or more, totaling simply over $15 billion raised in nine and 10 -figure mega-rounds alone. This set a record for crusade dealmaking.

We’ve already linked approximately when the uptick in gargantuan VC rounds began: towards the tail end of 2013. But where in the world are all the companies causing these supergiant venture capital rounds?

In response to coverage of July’s record-breaking multitudes, many commenters were quick to point out that startups based in China heightened six of the top 10 largest rounds from last month.

Indeed, on a recent occurrence of the Equity podcast discussing the supergiant round phenomenon, Chinese startups’ statu in world markets was a red-hot topic of dialogue. Someone suggested that a series of massive go rounds in China may have predated the run-up in supergiant rounds being raised by U.S. startups.

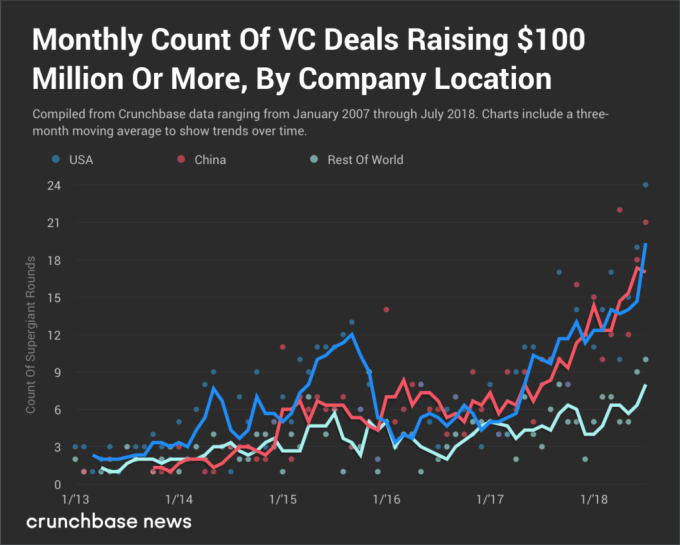

At least in the realm of nine and 10 -figure venture rounds, that doesn’t appear to be the case. The show below breaks down the monthly tally of supergiant rounds by the company’s country of origin.

Here is what this data hints 😛 TAGEND

The first major run-up in nine-figure dealmaking has just taken place in the U.S. around Q1 2014, whereas in China that first run-up didn’t appear until Q4 2014. Specially in the last 24 months or so, supergiant round work in China and the U.S. is most correlated, perhaps showing contender in world markets. We can be found in, very clearly, the mini-crash in the U.S. through the first six months of 2015. For its part though, China hasn’t yet had a serious “crash” in supergiant rounds during the course of its cycle. Startups outside the U.S. and China are beginning to raise supergiant rounds at a faster frequency, although the uptick is significantly less dramatic.

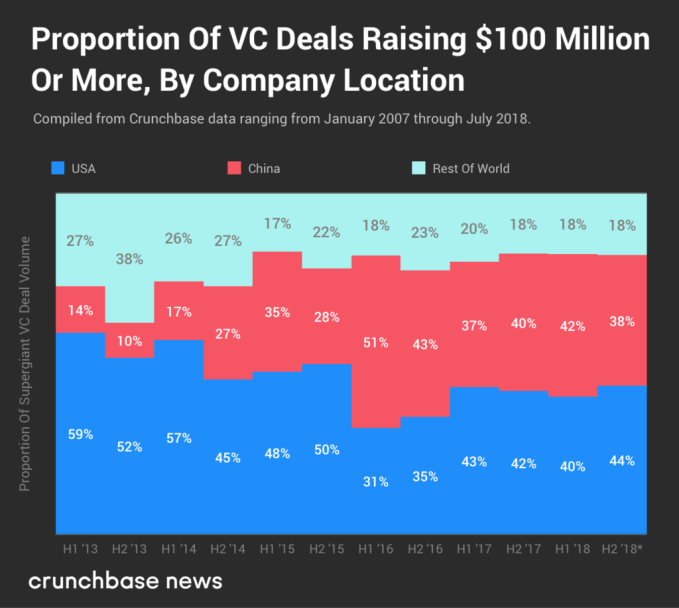

What’s less evident in the chart above is just how quickly China became a mega-round powerhouse. The planned below plans the same data as above, except this format demonstrates what percent of mega-rounds are generated by each grocery. Additionally, rather than exposing somewhat boisterous monthly amounts, we aggregated the data used in six-month increments.

After the beginning of 2013, it only took a couple of years for Chinese companies to consistently account for approximately 30 to 40 percent of the $100 million-plus VC rounds raised under any contributed six-month period.

This also reinforces a trend shown in the prior plot: since the opening up of 2017, Chinese startups and U.S. startups are promoting roughly the same number of supergiant bet rounds as one another. That amount has risen fairly consistently over time.

Before concluding, it’s worth mentioning that our description of “supergiant” is ultimately arbitrary. Indeed, $100 million is merely a tidy, round-numbered threshold to measure against. Our locates would be similar( if somewhat less dramatic) if we weighed, say, the primed of rounds heightening $50 million or more.

The important underlying trend is that round sizes are get larger on average. And a supergiant wave of coin ultimately promotes all rounds, at least a little bit.

Stay up to date with recent fund rounds, buys and more with the Crunchbase Daily.

Read more: feedproxy.google.com